BHAVANA INVESTMENT

THE HOUSE OF FINANCIAL INVESTMENT

contact@bhavanainvestment.com

+91-9879461615

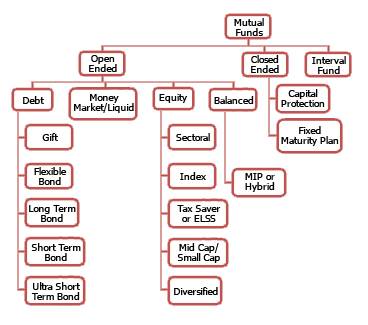

Mutual Funds

Based on the financial goals of investor, which may vary, based on his age, lifestyle, financial independence, family commitments and level of income and expenses among many other factors we assess his needs then begin by defining the investment objective. The objective may be regular income, buying a home or finance a wedding or educate your children or a combination of all these needs. Also the client's risk appetite and cash flow requirements need to be taken into account. Once the investment objective is clear. The next step is choosing the right mutual fund scheme.

Before choosing a mutual fund scheme we consider the following factors:

- NAV performance in the past track record of performance in terms of returns over the last few years in relation to appropriate yardsticks and other funds in the same category.

- Risk in terms of volatility of returns

- Services offered by the mutual fund and how investor friendly it is.

- Transparency, which is reflected in the quality and frequency of its communications.

Key Benefits of investing in Mutual Funds :

- Diversification

- Professional management and well regulated

- Disciplined investment approach

- Low transaction costs

- Liquidity

- Tax benefits

40+ Asset management companies, 2500+ Mutual fund schemes in the market. Confused where to invest?

Contact us to invest in the most suitable MF Scheme for you!