BHAVANA INVESTMENT

THE HOUSE OF FINANCIAL INVESTMENT

contact@bhavanainvestment.com

+91-9879461615

Equities

One of the best avenues to fight inflation

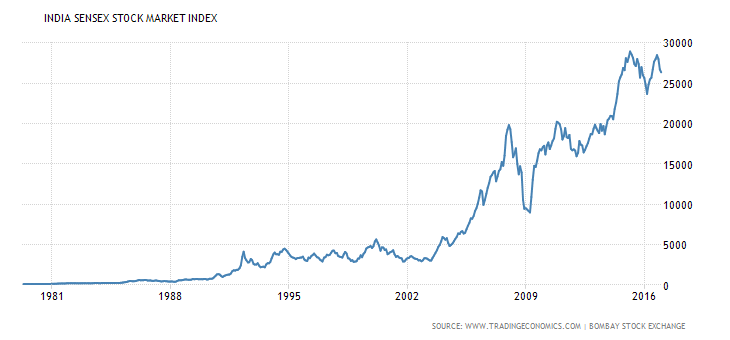

Inflation drives up the cost of living and eats away the value of your savings. Traditional investment avenues like Fixed Deposits, Bonds, etc. have a limited upside of 8 to 10 %, whereas equities as an asset class have given an average annual return of about 18 % in the last 10 years. Hence, when it comes to beating inflation, equities are undoubtedly your best bet

One of the most Liquid investment options

Equities also provide you the flexibility of quickly changing your holding patterns to suit your requirements and also convert your holdings into cash instantly. This makes it the most suitable option compared to other asset classes for investors who are looking for liquidity

Source of Long term wealth creation

Investing in good businesses and growth stories at an early stage provides unlimited upside potential. For example, your investment of Rs. 1,000 in the Infosys IPO in 1993, would have fetched you Rs. 30 Lakhs today.

Looking at the graph above, it must be clear that equities do give returns. But the question still remains unanswered that if Equity gives returns,Why people don’t make money out of equities. The answer lies in their EMOTIONS. The two basic emotions Greed & Fear will make you feel comfortable when the markets are going up and feel disheartened when the market goes down, even though one really don’t need to sell at that time. Always remember that equities is a long term investment and after you invest if emotions are making you restless, think about forgetting this investment. Checking daily profit or loss and anticipating the future growth has no meaning and is futile exercise.

In the end, invest in equities, but as a long term investor and partner the Indian Growth Story.